Halving + Liquidity Deficit

Introduction

Today we would like to analyze our observations related primarily to the technical and ideological component of BTC. these observations do not claim to be the absolute truth, however, today we can objectively evaluate them from the point of view of history.

We will talk about the Cycles of Bitcoin. we will look at the ups and downs, consider their dependence on the BTC holding.

Terms

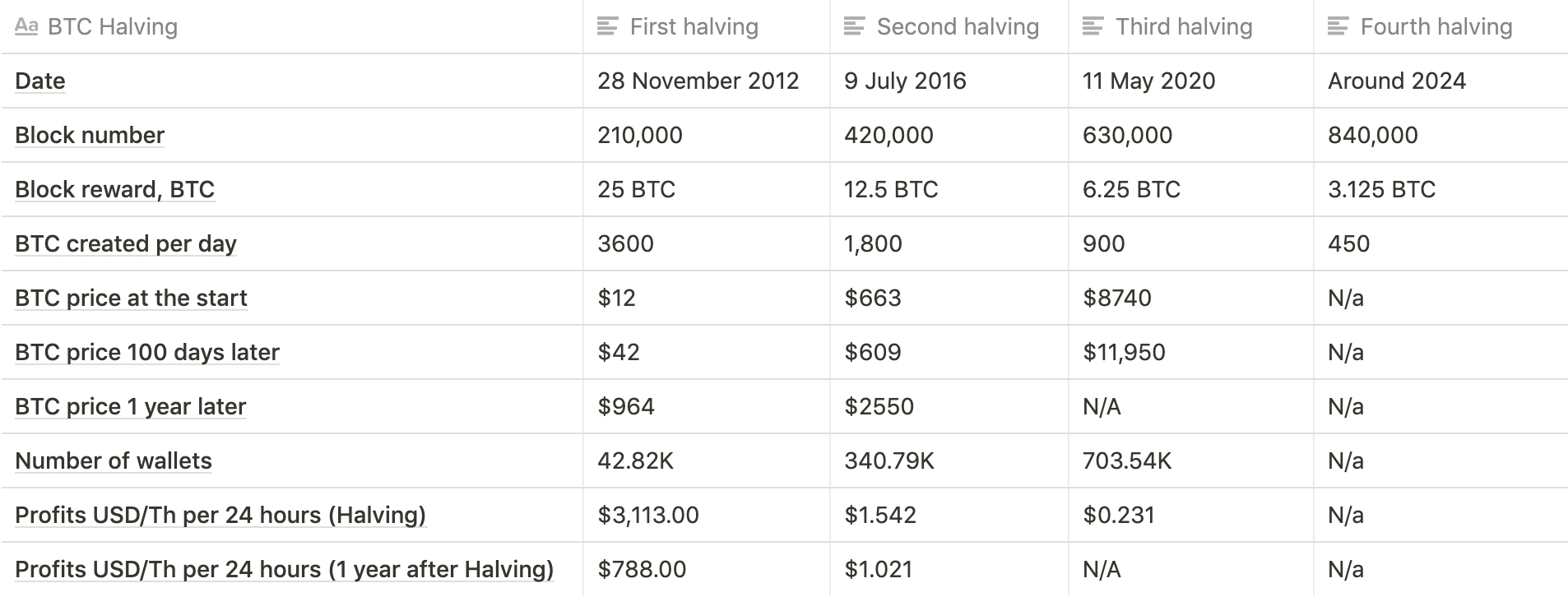

First, let's look at the information about all the past BTC Halvings.

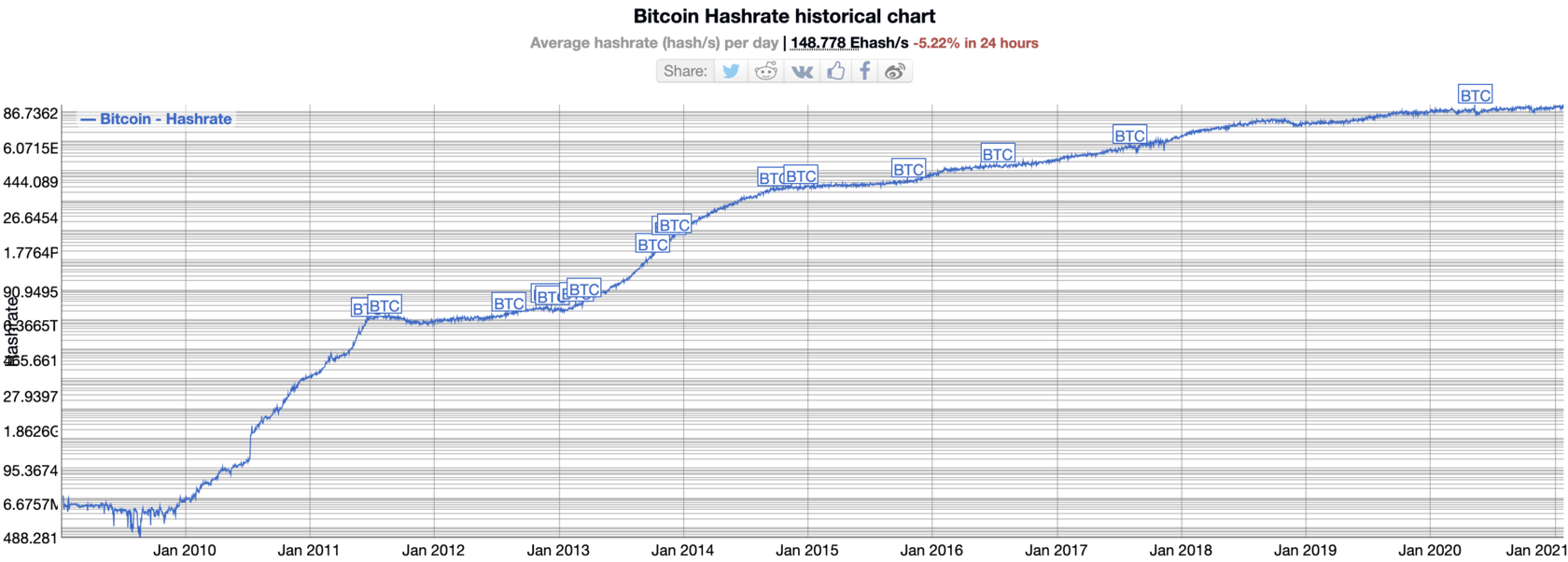

Bitcoin mining hardware first moved from the CPU to the GPU, and then to the FPGA and ASIC, but the proof-of-work principle remained the same. Over the years, technological improvements have made hashing a very efficient operation, consuming only 0.03 joules per billion hashes (with specially designed specialized integrated circuits, ASICs, etc.). This has reduced the cost of energy per hash by about thirty thousand times over the past 10 years. However, miners on the Bitcoin network are currently calculating hashes per day more than 10 orders of magnitude higher than the 2010 level.

At the same time, the network complexity, which has been steadily increasing since the zero block, as well as the hashrate of BTC itself, indicate an increase in the number of enabled mining equipment.

Thus, we have several prerequisites for a serious growth of BTC in the next 5 years, and, accordingly, the growth of mining as an industry:

- Elon Musk's PayPal has already added support for BTC. Bakkt has already been valued at $2bn. the level of mass adoption of cryptocurrencies will also continue to grow.

- the PoW technology in BTC will remain. the last coin mined is still more than a decade away

- the hashrate of the network has grown to historical peaks. A higher score usually means a more secure ecosystem, as this significantly increases the cost of attacks on the network.

- the strongest growth in interest in BTC in the last 10 years.

- the number of BTC wallets is currently growing by 400,000 units per day. by the end of 2021, 100,000 wallets are expected, this is

- the reward for the extracted block will continue to decrease,

Conclusions

Thus, the most stable and investment-attractive activity for a private investor, in the context of the cryptocurrency industry, was and remains Bitcoin mining. Only a BTC mining can afford stable, constantly increasing earnings at a distance. At the same time, altcoin mining is very volatile and often promises the owner to encounter often unfair conditions(sometimes bordering on fraudulent schemes, we will talk about this in subsequent articles), and can be recommended solely for reasons of speculative earnings. While Bitcoin mining has remained profitable and fair over the past 12 years, and the above data allows us to predict that the growth of the industry=returns will continue.